Hong Kong Departure Tax Refund: Eligibility and Application Guide

In June 2025, the Hong Kong government revised the Air Passenger Departure Tax Ordinance. The main revisions include two aspects:

- firstly, increasing the airport departure tax amount from HKD 120 to HKD 200, and

- secondly, including passengers departing via Hong Kong International Airport within two days of arriving in Hong Kong as tax-exempt persons.

In other words, after entering Hong Kong by any means, as long as you depart by air within two days, you can be exempt from paying the airport departure tax, and any tax already paid can be refunded. These revisions took effect from October 1, 2025.

This article will detail the new regulations for the revised Hong Kong Airport Departure Tax in 2025, including:

- who and which situations are eligible for a refund,

- the refund process and application steps,

- the refund amount and handling fees.

Hong Kong Airport Tax Refund 2025: Full Guide to Claim HK$200 Refund

Article Directory

Hong Kong Airport Departure Tax Exemption and Refund Eligibility – Who is exempt? Which situations qualify for a refund?

Before the 2025 revision, the following persons were already exempt from paying the Hong Kong Airport Departure Tax, and of course continue to enjoy exemption after the revision. These persons include:

- (A) Children under 12 years old;

- (B) Passengers in direct transit via Hong Kong Airport (without entering Hong Kong);

- (C) Passengers who arrive in Hong Kong by air and depart from Hong Kong by air via Hong Kong Airport on the same day;

- (D) Passengers arriving from Mainland China or Macao by land or sea who transfer directly to a flight departing Hong Kong via the restricted area of Hong Kong Airport (without entering Hong Kong).

For persons in categories (A) and (B) above, since they are clearly not required to pay the Hong Kong Airport Departure Tax, the airport tax is not included in the airfare when purchasing tickets, therefore no refund is needed.

For persons in categories (C) and (D), because it is not certain at the time of purchasing the ticket whether they qualify for exemption, the airport tax is included in the airfare, so they need to apply for a refund when departing from Hong Kong Airport.

Persons in category (D) can go directly to the refund counter to collect cash refund after checking in and passing security at the Hong Kong International Airport SkyPier Transit Hall. This procedure remains unchanged after October 1, 2025.

Persons in category (C) could previously complete the refund procedure and collect cash refund at the refund counter within Hong Kong International Airport. However, starting October 1, 2025, the refund counters located within the airport have been removed. Eligible passengers are now uniformly required to process refunds online.

The 2025 revision added the following persons as exempt from the Airport Departure Tax, effective October 1, 2025. These persons include:

- (E) Passengers who arrive in Hong Kong by air and depart from Hong Kong by air via Hong Kong Airport on the following day;

- (F) Passengers who enter Hong Kong by land or sea and depart from Hong Kong by air via Hong Kong Airport on the same day or the following day.

The (E) category above is essentially an extension of the (C) category, expanding the requirement from leaving Hong Kong on the same day to leaving within two days.

The main new exempt category in the 2025 revision is (F), i.e., passengers who enter Hong Kong by car, train, ferry, or cruise ship and depart by air via Hong Kong International Airport within two days (the same day or the next day) of arrival. These are primarily passengers transiting through Hong Kong from Mainland China or Macao.

Below is a comparison of the exempted categories for Hong Kong Airport Departure Tax before and after the legislative amendment, as well as the methods for tax refund or exemption:

| Exempted Categories before 1 Oct 2025 | Exempted Categories from 1 Oct 2025 onwards | Refund or Exemption Method |

|---|---|---|

| Children under 12 years old | Children under 12 years old | Air ticket does not include departure tax |

| Direct transit passengers | Direct transit passengers | Air ticket does not include departure tax |

| Passengers arriving by coach or ferry directly at the SkyPier Transfer Terminal for transfer | Passengers arriving by coach or ferry directly at the Hong Kong Airport Restricted Area for transfer | Collect refund at the tax refund counter in SkyPier Transfer Terminal |

| Passengers departing by air on the same day of arrival by air | – | Claim refund at the tax refund counter in Hong Kong Airport |

| – | Passengers departing by air on the day of arrival by air or the next day | Apply for refund online |

| – | Passengers who entered Hong Kong by land or sea and depart by air from Hong Kong Airport on the day of entry or the next day | Apply for refund online |

Important Notes for Tax Refund for Passengers Transferring via Hong Kong Airport after Entry

Previously, when traveling from Macao or Mainland China via Hong Kong International Airport to fly abroad, only those taking coaches that go directly into the restricted area of Hong Kong International Airport’s SkyPier Transit Hall (e.g., Macau Hong Kong Airport Direct Bus or Zhuhai Hong Kong Airport Sealed Bus) or speedboats (e.g., Ferry from Macau to Hong Kong Airport) could get a refund because they did not enter Hong Kong.

After the new revision, even if you use general transportation to Hong Kong, as long as you depart within two days, you are also eligible for a refund.

Now, even taking cheaper options like the “Hong Kong-Zhuhai-Macao Bridge Shuttle Bus” or driving to Hong Kong for transit, or needing to stay overnight at a Hong Kong airport hotel to catch an early morning flight the next day, you can get a refund, greatly increasing the attractiveness of flying via Hong Kong.

However, there are two points to note for persons in this category when determining their eligibility for exemption. First is the time gap between arrival and departure. The wording in the legislation is “the arrival day or the day following the arrival day“, meaning you must depart on the same day or the day immediately following the day you enter Hong Kong by land or sea, not within 48 hours. For example, if you arrive in Hong Kong at 15:00 on November 1st, you must depart by 24:00 on November 2nd at the latest to be eligible for exemption, not by 15:00 on November 3rd.

Also, the departure time from Hong Kong refers to the flight’s scheduled departure time, not the time the passenger clears immigration at the airport, and it is not affected by flight delays.

For example, if a passenger arrives in Hong Kong on November 1st, clears Hong Kong airport immigration at 23:00 on November 2nd, and the scheduled departure time of the departing flight is 00:30 on November 3rd, this situation does not qualify for exemption because the departure day (November 3rd) exceeds the arrival day (November 1st) or the following day (November 2nd).

Another example: a passenger arrives in Hong Kong on November 1st, and the scheduled departure time of the departing flight is 23:30 on November 2nd, but it is eventually delayed and takes off at 01:00 on November 3rd. This situation still qualifies for exemption.

The second point to note is that the legislation sets a restriction for this category of persons: they must not have departed Hong Kong by land or sea on the day of the flight departure or the day before.

For example, if a passenger arrives in Hong Kong by cruise ship on November 10th, takes a bus to Macau on the same day, stays overnight, and then takes a bus from Macau to Hong Kong International Airport (not a direct bus to the airport restricted area) on the next day (November 11th) to catch a flight leaving Hong Kong that day, this situation does not qualify for exemption and cannot get a refund.

This restriction is believed to be mainly used to prevent Hong Kong residents from abusing the new exemption conditions to evade tax. Without this restriction, Hong Kong residents could go to Shenzhen by land and then re-enter Hong Kong to take a flight and get a refund.

For tourists who visit Hong Kong and also travel to nearby Macau or Guangdong, if they want to get a refund, they need to pay attention to this restriction.

For example, if you first fly to Hong Kong, play in Hong Kong, then go to Macau, and then return to Hong Kong to fly home, you need to pay attention. If the dates are not managed well, you might not be eligible to refund the departure tax for the return flight from Hong Kong.

For example, a tourist flies to Hong Kong on November 10th, stays in Hong Kong for 3 days, then goes to Macau on November 14th. If they stay in Macau for 1 night and return to Hong Kong, and depart Hong Kong by air from Hong Kong Airport on November 15th, they do not qualify for exemption and cannot get a refund, because they departed Hong Kong by land the day before the flight departure day.

However, if they stay in Macau for 2 nights, return to Hong Kong on November 16th, and depart Hong Kong by air from Hong Kong Airport on the same day, they qualify for exemption and can get a refund. Or, if they stay in Macau for 1 night on November 14th, return to Hong Kong on November 15th and stay in Hong Kong for another night, and then depart Hong Kong by air from Hong Kong Airport on November 16th, they also qualify for exemption.

Hong Kong Airport Departure Tax Refund Process – Application channels, methods, timing, required documents and precautions

Starting October 1, 2025, applications for Hong Kong Airport Departure Tax refunds are uniformly processed online. The refund counters previously located within Hong Kong International Airport have been removed.

However, the refund procedure for passengers taking direct buses and ferries (speedboats) that go directly to the Hong Kong International Airport SkyPier Transit Hall remains unchanged. They will still receive a refund voucher after check-in, and then, after arriving at the SkyPier Transit Hall and passing security, go directly to the refund counter to collect the cash refund, without needing to apply separately.

Other persons eligible for exemption who have already been charged the Hong Kong Airport Departure Tax in their airfare need to use the official website to submit a refund application. Those who need to apply themselves are generally passengers who have entered Hong Kong and are checking in to depart from Hong Kong International Airport.

1. Application Channels, Methods and Timing

The website for applying for the Hong Kong Airport Departure Tax refund is https://www.apdtrefund.hk/. It offers three language options: Traditional Chinese, Simplified Chinese, and English. There is no dedicated mobile app.

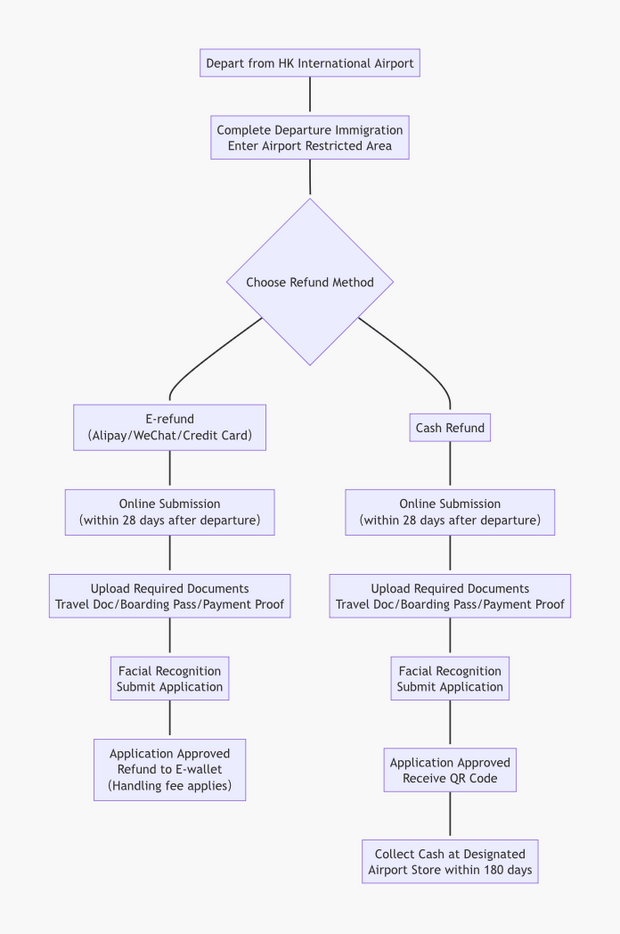

The refund process for the Hong Kong Airport Departure Tax generally includes the following three steps:

- Depart from Hong Kong International Airport;

- Submit the refund application on the refund application website;

- Receive the refund amount.

The refund application can only be submitted after departure. You can pre-fill information and upload required documents, but you can only perform the “facial recognition” and submit the application after completing the departure procedures at the Customs inspection counter inside the airport.

Additionally, the refund application must be submitted within 28 days of departure (including the departure day). Eligibility is lost after this period.

Below is the flowchart for applying for the Hong Kong Airport Departure Tax refund:

2. Required Documents

Applying for a Hong Kong Airport Departure Tax refund requires providing the following three documents:

- Travel document used to enter Hong Kong;

- Boarding pass for the departing flight;

- Proof showing that the Hong Kong Airport Departure Tax has been paid.

(1) Travel Document Used to Enter Hong Kong

Generally, the travel document used to enter and depart Hong Kong should be the same. For example:

- Hong Kong residents usually use their Hong Kong Permanent Identity Card;

- Macau residents usually use their Macau Resident Identity Card;

- Mainland Chinese residents usually use their Mainland Travel Permit for Hong Kong and Macau (Home Return Permit);

- Taiwan residents can use the Taiwan Compatriot Permit (Mainland Travel Permit for Taiwan Residents), or their Republic of China Passport (must also hold the Pre-arrival Registration for Taiwan Residents notification, commonly known as “Hong Kong Visa” or “e-HK Visa”);

- Foreigners generally use their passport.

If different travel documents were used for entry and departure, the document used to enter Hong Kong should be used for the refund application, not the document used for departure at the airport.

When applying for the refund, you need to upload a photo of the travel document, so you can pre-take a photo of the document with your phone for easy uploading during application. If using an ID card or travel permit, both the front and back of the document need to be uploaded. If using a passport, only the data page is needed.

(2) Boarding Pass for the Departing Flight

After checking in at Hong Kong International Airport or the Airport Express in-town check-in counters, you will receive a paper boarding pass. After obtaining the boarding pass, you can take a photo of it with your phone for easy uploading during application. If using an electronic boarding pass, you can directly use a screenshot of the electronic boarding pass.

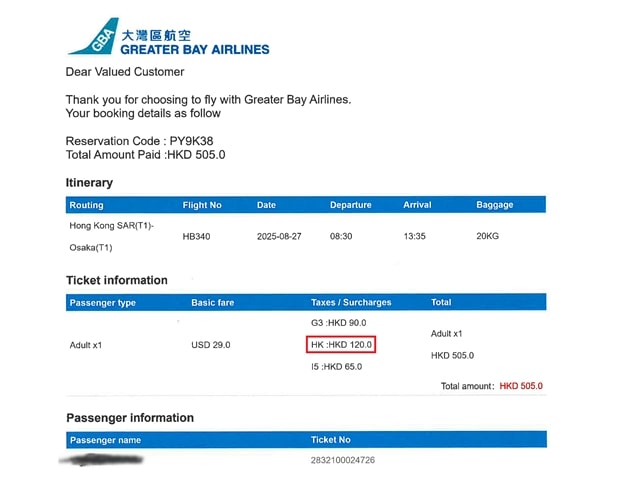

(3) Proof Showing Payment of Hong Kong Airport Departure Tax

The refund is for the tax already paid, so to get a refund, you must provide proof that you paid the Hong Kong Airport Departure Tax when purchasing your air ticket. If purchasing tickets through an airline’s official website, the itinerary receipt usually lists the various components of the airfare cost. If there is an item for Hong Kong Airport Departure Tax, this can serve as proof of payment.

When purchasing tickets through a travel agency store, the itinerary provided by the agency usually also shows the departure tax item. If not, you can ask the agency to provide an itinerary that shows the detailed breakdown.

When booking tickets through online travel platforms, currently most platforms provide itineraries that only show the total “Taxes and Fees”, without a separate item for Hong Kong Airport Departure Tax. In this case, there are two ways to obtain an itinerary showing the departure tax item:

- Contact the customer service of the platform where you purchased the ticket and request an itinerary that shows the airport departure tax as a separate item;

- On the airline’s official website or mobile app, enter the e-ticket number, passenger name, and other details to log into the “Manage Booking” system, then download the airline’s itinerary receipt.

Here are the URLs for the “Manage Booking” webpages of four Hong Kong-based airlines:

3. Application Process

After preparing the three documents mentioned above and completing the departure procedures at the Hong Kong International Airport Customs counter, you can use the Hong Kong Air Passenger Departure Tax Refund Website to submit your refund application.

The refund application platform offers three languages: Traditional Chinese, Simplified Chinese, and English. You can switch languages by clicking the language menu in the top right corner of the webpage.

The online application process for the Hong Kong Airport Departure Tax refund generally includes the following three steps:

- Upload required documents;

- Choose the method for receiving the refund;

- Submit the application.

Here are the detailed steps for the application:

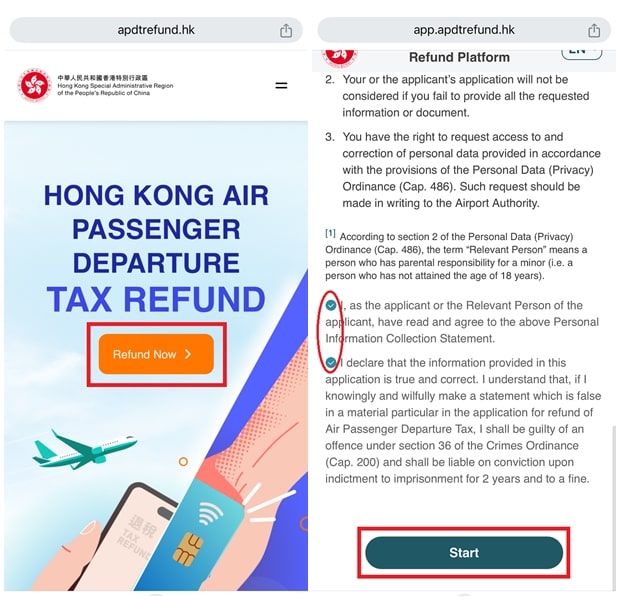

【Step 1】After entering the refund application website, click the 「Refund Now」 button, then check the two declarations under the “Personal Information Collection Statement”, and click the 「Start」 button.

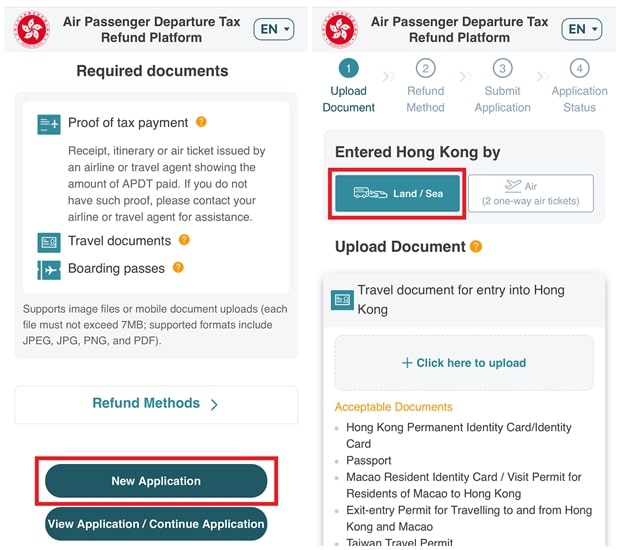

【Step 2】After entering the refund platform, click the 「New Application」 button, then select the “Method of entering Hong Kong” (Land/Sea, or Air).

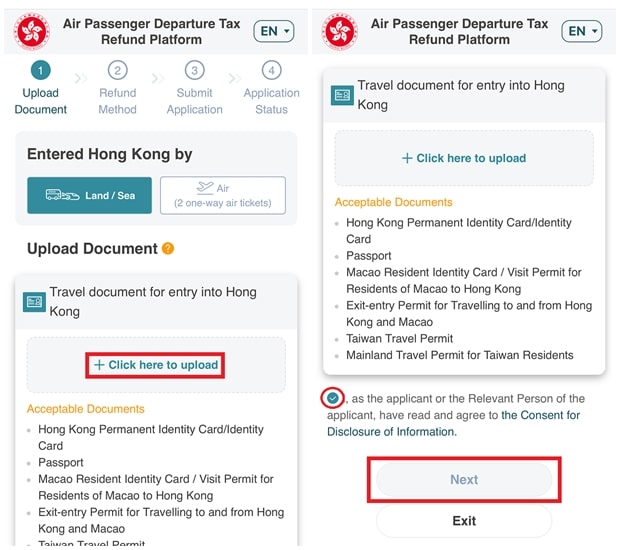

【Step 3】Upload photos of the three documents: “Travel document used to enter Hong Kong“, “Boarding pass for departing flight“, and “Proof of payment for Air Passenger Departure Tax“. After checking the agreement to the relevant terms of use, click the 「Next」 button.

If the uploaded boarding pass and itinerary (proof of payment) have clear information, the system can generally automatically recognize and approve them. If the system cannot recognize them, it will display a message like “The submitted information requires further review, the application will be transferred for manual processing.”.

If the itinerary has multiple pages, do not upload them as separate images, as the system cannot automatically recognize multiple images. It is recommended to merge them into one photo before uploading. Also, if the itinerary contains multiple journey segments, it’s best to obscure the information for segments not related to the departure from Hong Kong.

Applications submitted under circumstances requiring manual processing will not be approved immediately. Instead, you need to wait for manual approval before receiving the refund, which usually takes at least 3 working days.

If you did not choose cash refund and are not in a hurry to receive the refund, you can still submit the application. But if you chose cash refund, you should retake and re-upload the problematic documents until the system can automatically recognize and approve them, otherwise you might not be able to collect the cash refund at the airport on the same day.

After uploading the travel document, the system will save your information and assign an Application Reference Number. You can take a screenshot to save this number. If you pause the application midway, for example, uploading the required documents before departure and then continuing to submit the application after completing the departure procedures, you can click the 「View Application / Continue Application」 button in Step 2, then enter the Document Number and Reference Number to retrieve the application record and continue submitting the application, or check the application status.

If you lose the reference number, you can also use the document number + date of birth + departure flight date to retrieve the application record, but this only works if the boarding pass has already been uploaded.

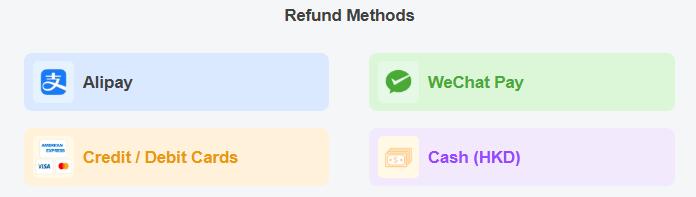

【Step 4】Choose the method for receiving the refund amount. There are four options for receiving the refund: Receive Cash, Refund to Credit Card account (only Visa, Mastercard, and American Express), Refund to Alipay account, and Refund to WeChat Pay account. Alipay and WeChat Pay are only available for accounts verified with a Mainland China ID card. Non-Mainland residents can only choose cash or credit card.

Except for cash, the other three refund methods incur a handling fee. The handling fee for Alipay and WeChat Pay is 1.9% (approximately HKD 3). The handling fee for credit cards varies by card company, generally ranging from 2% to 7%.

【Step 5】Perform facial recognition to complete the refund application. Note that this step must be performed after departure (after completing the Customs departure procedures). If the uploaded documents are clear and the system can automatically recognize them, the refund application can generally be approved immediately. (Note: The screenshot below is the Chinese version)

Note: The bottom right corner of the review results page will display a reference number. You can use this number to log into the system to check your application details, and if necessary, you can also change the refund receiving method.

If manual processing is required, it will display “Your application has been received”, along with an application reference number. You can also fill in your email address to receive the review results.

If you choose cash refund, a QR code will be displayed. You can then go to any currency exchange shop within Hong Kong Airport, present the QR code for verification, and receive HKD cash. The QR code for cash refund is valid for 180 days.

If you cannot collect the refund on the same day, you can return to any currency exchange shop within Hong Kong International Airport to collect it within the validity period. If you cannot return to Hong Kong Airport to collect the cash refund, you can use the reference number to log into the refund platform and change the receiving method.

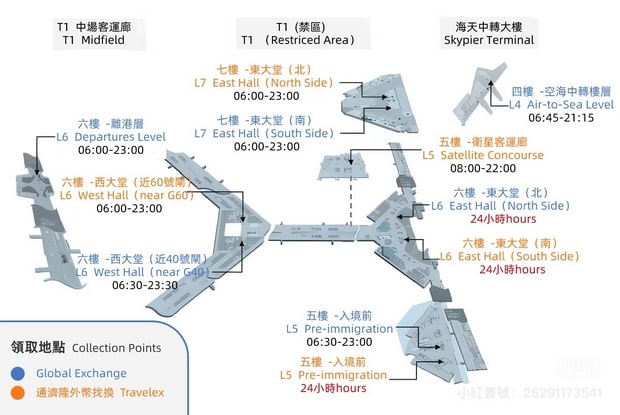

Below is a location map of currency exchange shops within Hong Kong International Airport.

If you choose refund to credit card, Alipay, or WeChat Pay, the refund amount will be deposited directly into the respective account. However, the time to receive the funds depends on the processing by the credit card company or payment tool. Alipay and WeChat Pay generally receive the funds within 3 days.

Hong Kong Airport Departure Tax Refund Amount – $200 or $120?

The 2025 amendment to Hong Kong’s Air Passenger Departure Tax Ordinance will increase the Air Passenger Departure Tax amount from October 1, 2025, from HK$120 to HK$200. However, this does not mean that the refund amount will be HK$200 starting from October 1, 2025.

The refund amount depends on how much Hong Kong Airport Departure Tax you paid when you purchased your air ticket. If you paid $200 in tax, you will get a $200 refund; if you paid $120 in tax, you will get a $120 refund.

The Hong Kong Airport Departure Tax is levied at the moment the airline sells the air ticket. Therefore, the new tax amount (HK$200) effective from October 1, 2025, only applies to tickets sold on or after that date; it is not related to the flight departure date.

In other words, if you purchased a ticket before October 1, 2025, for a flight departing after October 1, the airport tax paid at the time of purchase would still be HK$120. Therefore, the refund amount you can reclaim is HK$120, not HK$200. For tickets purchased on or after October 1, 2025, the tax paid is HK$200, so the refundable tax amount is HK$200.

Below is the refund amount for airport tax based on different air ticket purchase dates:

| Air Ticket Purchase Date | Before 1 Oct 2025 | On or after 1 Oct 2025 |

|---|---|---|

| Refund Amount | HK$120 | HK$200 |

【Reference Materials】Below are the official websites regarding the Hong Kong Airport Departure Tax legislation and refund application:

- Hong Kong Air Passenger Departure Tax Ordinance Text

- Hong Kong Civil Aviation Department Introduction to Air Passenger Departure Tax

- Hong Kong Air Passenger Departure Tax Refund Application Platform

- Locations of Global Exchange Counters for Cash Refund at Hong Kong International Airport

- Locations of Travelex Counters for Cash Refund at Hong Kong International Airport

- Tax Refund Counter at Hong Kong International Airport SkyPier Transfer Terminal

IV. Frequently Asked Questions

Below are some common questions frequently encountered by passengers when applying for the Hong Kong Airport Departure Tax refund. If your question is not answered here, feel free to ask in the comments.

1. Questions Regarding Refund Eligibility

【Q1】What is the Hong Kong Departure Tax? Do I need to pay it every time I leave Hong Kong?

【A】The official name is “Hong Kong Air Passenger Departure Tax”, also known as “Airport Departure Tax”. It is a tax levied on passengers departing from Hong Kong International Airport by air. Currently, this tax is only levied on passengers departing from Hong Kong Airport. Departing via other land or sea border control points does not require payment of this tax.

【Q2】How is the Hong Kong Air Passenger Departure Tax collected?

【A】The Hong Kong Air Passenger Departure Tax is an additional fee included in the airfare. It is collected by the airline when the passenger purchases the ticket. Passengers do not need to pay this tax separately.

【Q3】Who is exempt from the Hong Kong Airport Departure Tax?

【A】According to the newly amended legislation effective 2025, the following passengers departing from Hong Kong International Airport are currently exempt:

- Children under 12 years old;

- Passengers in direct transit;

- Transfer passengers arriving by coach or ferry directly at the Hong Kong Airport Restricted Area without entering Hong Kong;

- Passengers departing by air on the day of arrival by air or the next day;

- Passengers who entered Hong Kong by land or sea and depart by air from Hong Kong Airport on the day of entry or the next day, provided that the passenger does not have a record of departing Hong Kong by land or sea on the day of their flight departure or the day before.

【Q4】How can exempt passengers reclaim the tax if it was already paid?

【A】If the airfare already includes the Airport Departure Tax, exempt passengers can apply for a refund. The method to reclaim the tax depends on how the passenger arrives at Hong Kong Airport. Passengers arriving by coach or ferry directly at the SkyPier Transfer Terminal within the airport restricted area for transfer can collect cash refund directly at the tax refund counter in the SkyPier Transfer Terminal without needing to apply. Passengers who check-in and depart from the Hong Kong Airport departure hall need to apply for the refund themselves via the online platform.

【Q5】Why is there no refund for children?

【A】Children under 12 are exempt from the Hong Kong Airport Departure Tax. Therefore, the airfare for children under 12 does not include the departure tax, so there is no tax to refund.

【Q6】I am travelling from Kuala Lumpur to Tokyo via Hong Kong. Due to a layover exceeding 10 hours, I entered Hong Kong and visited the city for a few hours before returning to the airport for my flight. Am I eligible for a tax refund in this case?

【A】Eligibility depends on whether the airfare included the Hong Kong Air Passenger Departure Tax. If the ticket from Kuala Lumpur to Tokyo via Hong Kong was issued as a single ticket, the Hong Kong Departure Tax is generally not charged, so there is no refund issue. However, if separate tickets were issued (e.g., one for Kuala Lumpur to Hong Kong and another for Hong Kong to Tokyo), and the Hong Kong to Tokyo ticket included the Hong Kong Airport Departure Tax, then you can apply for a refund for that segment.

【Q7】Is the tax refund only available for one-way tickets departing from Hong Kong or round-trip tickets starting in Hong Kong? Can I get a refund for a round-trip ticket from another location to Hong Kong?

【A】Apart from passengers who are directly exempt (like children and transit passengers), all airfare for flights departing from Hong Kong includes the Hong Kong Air Passenger Departure Tax. Therefore, round-trip tickets from another location to Hong Kong also include this tax in the fare for the departing flight from Hong Kong. If you meet the refund conditions, you can apply for a refund.

【Q8】Is it true that I am eligible for a refund as long as I depart by air within 48 hours of entering Hong Kong?

【A】No. The legislation specifies departing by air on the day of entry or the next day. This is calculated by calendar day, not by a 48-hour period from the time of entry.

【Q9】What is considered the departure time? Is it the time I pass through the Hong Kong immigration counter?

【A】The departure time refers to the scheduled departure time of the flight as shown on your ticket, not the time you pass through the Hong Kong immigration control counter, nor the actual take-off time of the aircraft.

【Q10】I arrived in Hong Kong from Macau on Jan 1, stayed one night, and took a flight scheduled to depart at 23:00 on Jan 2 from Hong Kong Airport. However, the flight was delayed and eventually took off at 01:20 on Jan 3. Am I eligible for a refund in this case?

【A】Yes.

【Q11】Are Hong Kong residents not eligible for the tax refund?

【A】Not necessarily. The legislation does not prohibit any person from being eligible. As long as the refund conditions are met, Hong Kong residents can also get a refund. However, as Hong Kong residents typically start their journey from Hong Kong, they usually do not meet conditions like “depart within two days of entering Hong Kong” or “arrive by coach/ferry directly at the airport restricted area”. Thus, they are often ineligible. But if a Hong Kong resident travels to Hong Kong Airport from Macau or Mainland China to depart, they would generally meet the conditions for a refund.

【Q12】I will be taking a flight departing at 5:00 AM from Hong Kong Airport, so I plan to arrive in Hong Kong the day before and stay at an airport hotel for convenience. Am I eligible for a refund?

【A】Yes, as long as you depart by air on the day of entry or the next day, you are eligible.

【Q13】I took the high-speed rail from Guangzhou to Hong Kong, entered Hong Kong, took a ferry from Sheung Wan Pier to Macau on the same day, and then took a coach from Macau to the Hong Kong Airport departure hall the next day to check-in and take a flight to London. Am I eligible for a refund?

【A】No. For passengers who entered Hong Kong by land or sea and depart by air within two days, if they have a record of departing Hong Kong by land or sea on the day of their flight departure or the day before, they are not eligible.

【Q14】I took the high-speed rail from Guangzhou to Hong Kong, entered Hong Kong, took a ferry from Sheung Wan Pier to Macau on the same day, and then took an airport bus from Macau directly to the SkyPier Transfer Terminal the next day to check-in and take a flight to London. Am I eligible for a refund?

【A】Yes. Transfer passengers arriving by coach or ferry directly at the Hong Kong Airport Restricted Area without entering Hong Kong can collect the refund directly.

【Q15】I flew from Singapore to Hong Kong, did not enter Hong Kong upon landing, took an airport bus directly to Macau for a meeting, then took a ferry from Macau to Hong Kong for sightseeing the next day, and finally took a flight from Hong Kong Airport back to Singapore that evening. Am I eligible for a refund?

【A】Yes. You did not enter Hong Kong on the first day, so you did not violate the rule concerning “departing Hong Kong by land or sea on the day of the flight departure or the day before”.

【Q16】I flew from Singapore to Hong Kong, entered Hong Kong on the day of arrival, then took a client-provided car to Macau for a meeting, and was driven back by the client to Hong Kong Airport the next day to take a flight back to Singapore. Am I eligible for a refund?

【A】Yes. This situation meets the exemption rule for “departing by air on the day of arrival by air or the next day”. Although you departed by land the day before your flight, this restriction only applies to passengers who entered Hong Kong by land or sea before their flight; it does not apply to passengers who arrived by air.

2. Questions Regarding the Application Process

【Q1】How should I apply for the refund if I take an airport express bus from Macau to the SkyPier Transfer Terminal for transfer?

【A】Passengers transferring via the SkyPier Transfer Terminal do not need to submit any application. When checking in at the SkyPier Transfer Terminal or at the point of origin, they will receive a refund voucher. After passing security at the SkyPier Transfer Terminal, they can collect the cash refund at the tax refund counter.

【Q2】How should I apply for the refund if I take a ferry from Guangzhou to the Hong Kong Airport SkyPier for transfer?

【A】Answer is the same as above. You can collect the cash refund directly at the tax refund counter in the SkyPier Transfer Terminal; no application is needed.

【Q3】How should I apply for the refund if I drive to the Hong Kong Port Transfer Car Park for transfer?

【A】After parking or alighting at the Hong Kong Port Transfer Car Park, you need to take a shuttle bus to the SkyPier Transfer Terminal to check-in. Upon completion, you will receive a refund voucher. After passing security at the SkyPier Transfer Terminal, you can collect the cash refund at the tax refund counter.

【Q4】Where can I get the refund voucher?

【A】You will receive your boarding pass and the refund voucher after completing check-in at the SkyPier Transfer Terminal or at your point of origin.

【Q5】Do I need to show identification when collecting the refund at the SkyPier Transfer Terminal tax refund counter? Does it require personal collection?

【A】Only the refund voucher needs to be presented to collect the refund. It can be collected by someone else on your behalf.

【Q6】What should I do if I forget to collect the refund at the tax refund counter after passing security at the SkyPier Transfer Terminal?

【A】You can contact the airline for assistance.

【Q7】Through which channels can I apply for the Hong Kong Airport Departure Tax refund?

【A】The Hong Kong Airport Departure Tax refund can be applied for via the “Hong Kong Air Passenger Departure Tax Refund” website (URL: https://www.apdtrefund.hk/). You can also access the refund application website through the “Tax Refund Guide” link within the Hong Kong International Airport WeChat Official Account.

【Q8】When is the earliest I can apply for the Hong Kong Departure Tax refund? What is the latest deadline?

【A】The Hong Kong Airport Departure Tax refund application can only be submitted after you have departed from Hong Kong, i.e., after you have passed through the airport immigration control counter. The application must be submitted within 28 days from the date of departure.

【Q9】If multiple people are travelling together, can I submit a single refund application for all of them?

【A】No. Each applicant needs to submit a separate application, upload their own documents, and complete facial recognition individually. However, this can be done using the same mobile device.

【Q10】Does the travel document uploaded during the refund application refer to a passport?

【A】Not necessarily. The travel document uploaded should be the one you used to enter Hong Kong. If you used your Identity Card to enter Hong Kong, then it’s your Identity Card. If you used a passport, then it’s your passport.

【Q11】Can I use an electronic boarding pass?

【A】Yes.

【Q12】Can I use the purchase receipt for the air ticket as proof of tax payment?

【A】If the receipt shows necessary information such as passenger name, flight departure time, and the amount of Hong Kong Airport Departure Tax, it can be used as proof of tax payment.

【Q13】How can I obtain an itinerary that shows the departure tax amount?

【A】If the ticket was purchased directly from the airline’s website, the itinerary sent to you by the airline usually itemizes the departure tax amount. If the ticket was purchased through a travel agent or online platform, and the e-ticket provided does not show the tax amount, you can contact the agent or platform for assistance. Alternatively, you can use your passenger name and ticket number to log into the airline’s ticket management system on their website and print an itinerary that separately displays the departure tax amount.

【Q14】What should I pay attention to when uploading the itinerary?

【A】When uploading the ticket or itinerary, only one file should be uploaded. If the itinerary information spans multiple pages, merge them into a single image before uploading. Also, for round-trip tickets, only upload the details for the flight departing from Hong Kong. If multiple flight segments are on the same page, you can use an editing tool to obscure the other segments to avoid confusion for the system.

【Q15】Is the refund application approved instantly?

【A】If the uploaded documents (travel document, boarding pass, itinerary) are clear and can be automatically recognized by the system, the refund application is usually approved instantly and automatically. If the documents are unclear and the system cannot process them, the application will be forwarded for manual review.

【Q16】If the application status shows it requires manual review after submission, can I resubmit the application?

【A】Yes. If you prefer not to wait for manual review, you can improve the quality of the uploaded document photos and resubmit the application until it passes the automated system review.

【Q17】If I cannot take the flight after purchasing the ticket, and the airline does not allow a ticket refund, can I still get the airport departure tax refunded?

【A】Yes. If you did not take the flight, you can contact the booking platform or the airline to refund the airport departure tax.

【Q18】If I encounter an unresolved issue during the refund application, is there customer support I can contact for help?

【A】You can email APDTRefund@hkairport.com for assistance.

3. Questions Regarding Receiving Funds and Handling Fees

【Q1】What is the refund amount for the Hong Kong Airport Departure Tax?

【A】For tickets purchased before 1 October 2025, the Hong Kong Airport Departure Tax amount is HK$120, so the refund is HK$120. For tickets purchased on or after 1 October 2025, the tax amount is HK$200, so the refund for tickets purchased from that date onwards is HK$200.

【Q2】What are the options for receiving the refund?

【A】There are four options for receiving the refund:

- Receive cash;

- Refund to credit card account (Visa, Mastercard, and American Express only);

- Refund to Alipay account;

- Refund to WeChat Pay account.

However, Alipay and WeChat Pay are only available for accounts verified with a Mainland China ID card. Non-Mainland residents can only choose cash or credit card.

【Q3】Are there any handling fees for receiving the refund? Approximately how much are they?

【A】Receiving a cash refund does not incur a handling fee. However, the three electronic methods (credit card, Alipay, WeChat Pay) charge a handling fee. Alipay and WeChat Pay charge 1.9% (approximately HK$3-4). Credit card fees vary by card issuer, generally ranging from 2% to 7%.

【Q4】Can the payment method be changed after submitting the application?

【A】If you initially chose to receive a cash refund, you can change the payment method to another option at any time before actually collecting the cash. However, if you initially chose credit card, Alipay, or WeChat Pay, it cannot be changed.

【Q5】In which currency is the cash refund paid? Can I choose a different currency?

【A】Cash refunds are paid in Hong Kong Dollars only. Other currencies are not available.

【Q6】How long is the validity period for collecting the cash refund?

【A】The cash refund must be collected within 180 days from the date of approval.

【Q7】What documents are needed to collect the cash refund? Can someone else collect it on my behalf?

【A】When collecting the cash refund, you only need to present the QR code displayed after approval. No identification or other documents are required. It can be collected by someone else on your behalf.

【Q8】Where can I collect the cash refund?

【A】The cash refund can be collected at any of the currency exchange counters within Hong Kong International Airport.

Related Articles:

- 【Hong Kong Accommodation Recommendation】Royal Plaza Hotel: Convenient Location, Spacious Rooms

- From Zhuhai/Macau to Hong Kong Airport via Hong Kong-Zhuhai-Macao Bridge: Airport Express Bus, Golden Bus Guide + Land/Sea Route Comparison

- Macau International Fireworks Display Contest

- Macau Grand Prix: Event Dates, Schedule, Tickets, and Grandstand Guide

- Agoda Flights: Booking Process, Ticket Collection, Seat Selection, Reviews, and Price Comparison